When a Payment Is Made on an Account Payable

Things you plan to pay off within the year - ideally well within the year. It represents the purchases that are unpaid by the enterprise.

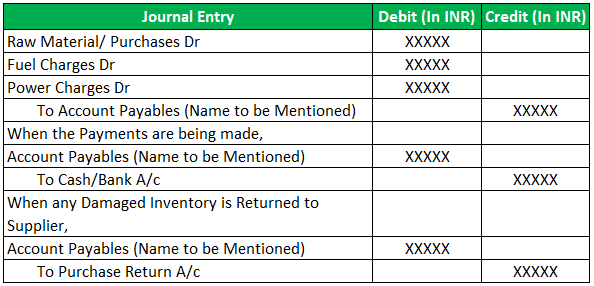

Accounts Payable Payment Double Entry Bookkeeping

The Purpose of Accounts Payable in Business.

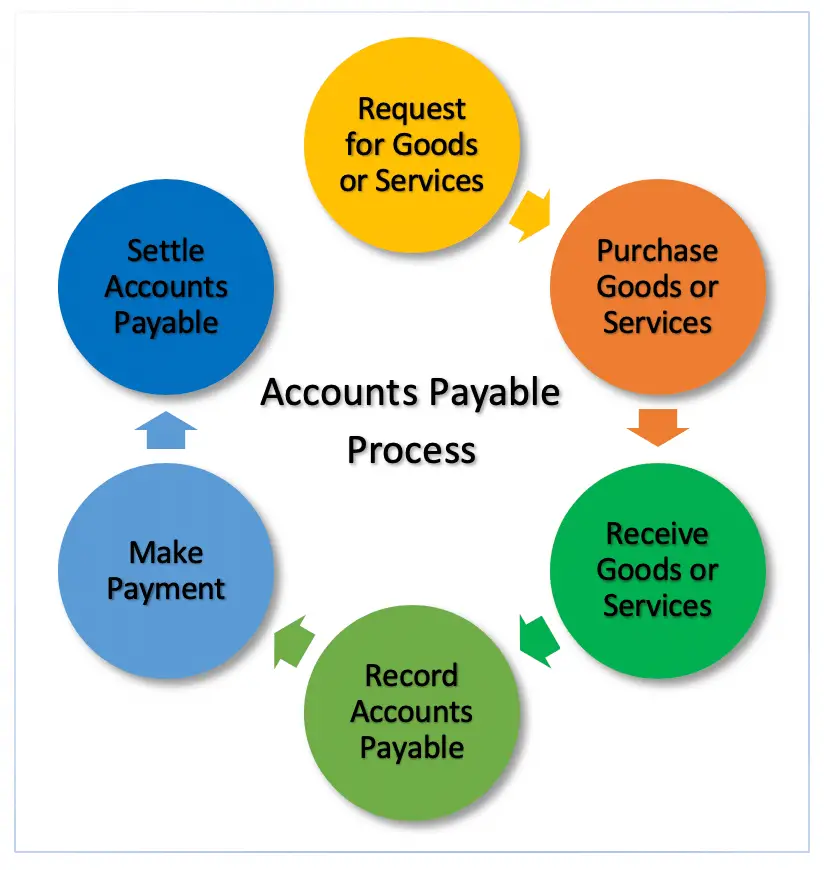

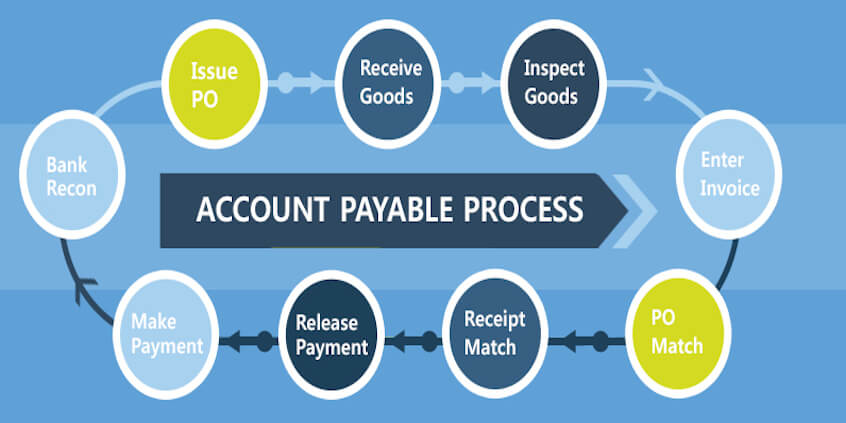

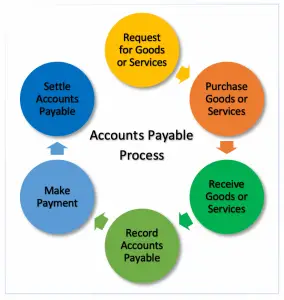

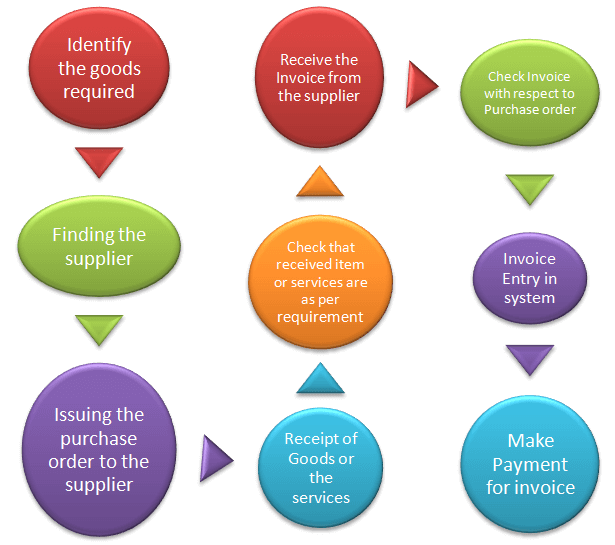

. The Accounts Payable AP is the amount of money that a business entity owes to vendorssuppliers for availing of their goodsservices. The accounts payable process may involve seven steps including. Thus your vendors supplying goods on credit are also referred to as trade creditors.

Once payment is made to the supplier the net accounting entry increases the assetsexpenses and decreases the cash. Purchase Goods or Services. In proALPHA Financial Accounting you create a partial payment invoice by creating an account payable.

Are recorded by a company when it purchases goods and services on credit and will make payment in a future period. Accounts payable Dr Cash Cr. When payment is made against an account such that the entry in the accounts payable of a companys books is no longer outstanding it is referred to as paid on account.

Role of Accounts Payable. Report and pay external business expenses. When the payment is made to payable or creditor the accounts payable liability reduces which is recorded by making the following journal entry.

There are always two entries in double-entry bookkeeping one is the credit entry and the other is a debit entry. When a company purchases something on account payable the account payable is where the credit entry is done and the purchase entry is where the debit entry is done. Request for Goods or Services.

5 Entry when the payment is made to the creditor or to payable. View the full answer. Before your company receives goods or services from a supplier you make a partial payment.

Creditors are liabilities which increase on the right side credit and decrease on the left side debit. After the creation and recording of the accounts payable liability when the payment is made to the creditor or to payable then there will be the reduction in the accounts payable liability and the same will be recorded by making a journal entry as follows. So accounts payable are what you owe to your vendor or supplier for items or services purchased on credit.

Payments made on account. 22 Accounts Payable Invoice Processing It consists of paying releasing and entering of invoices. Accounts payable account Cr 5.

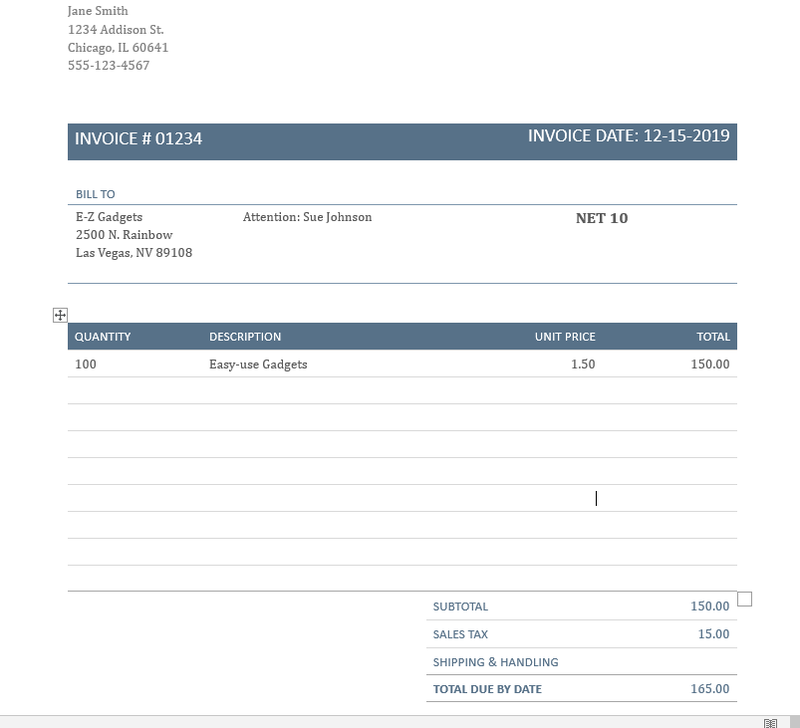

The balance of accounts payable in the liability section is reversed when payment is made to the supplier. When any goods or services are purchased on credit from your vendor or supplier they will send you an invoice. Accounts payable are commercial obligations that arise in the normal course of doing business when companies purchase inventory supplies materials equipment and services on credit.

Usually accounts payable refers to short-term debts ie. At the corporate level AP refers to short-term debt payments due to suppliers. Accounts payable are debts that must be paid off within a given period to avoid default.

In other words you are paying off a creditor. The Accounts Payable or Account Payable AP is the amount of money that a business entity owes to vendorssuppliers for availing their goodsservices. When accounts payable items are paid the accounts payable account is debited with cash credited.

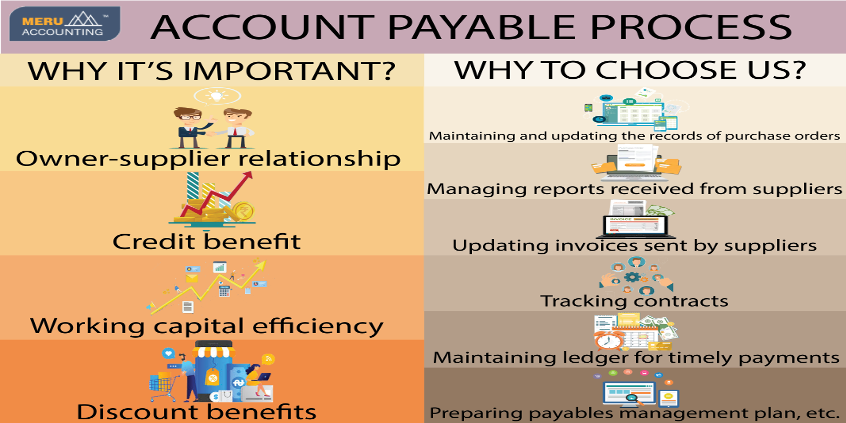

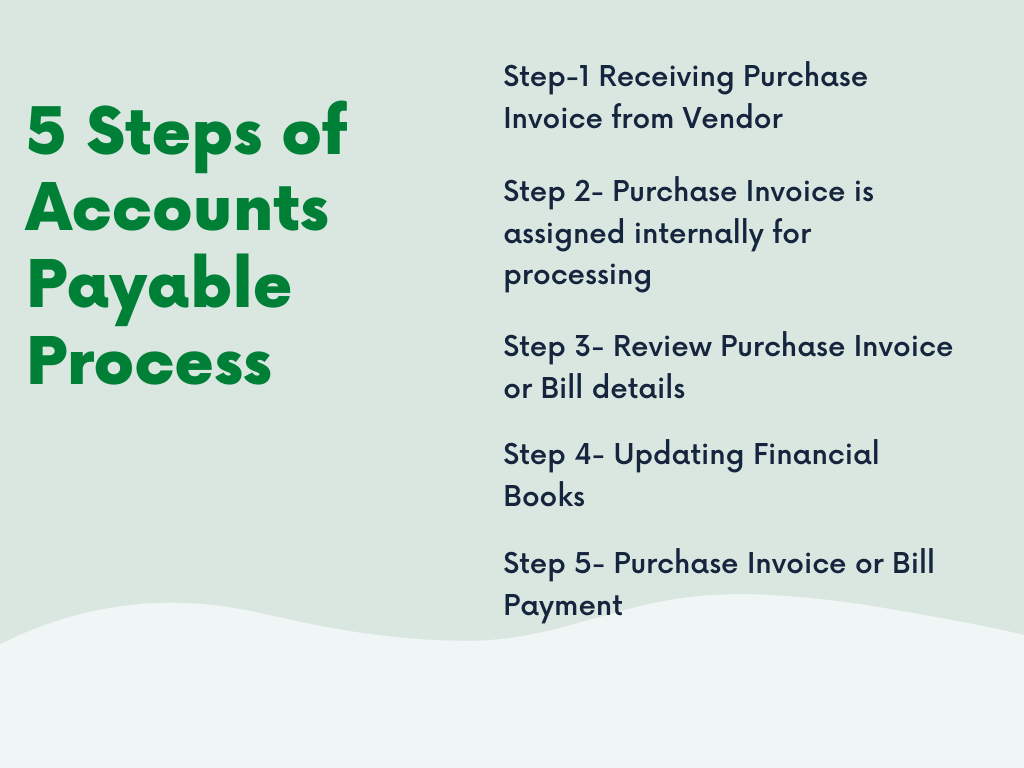

The Accounts Payable Process is the management and execution of the companys short-term payment obligations to the vendorsupplier. Accounts payable process usually starts with the request of the goods to be purchased to the purchasing department or the responsible personnel until the payment is made to the supplier of goods or services. The Accounts Payable section is responsible for processing invoices for goods and services on behalf of the University.

That is you purchase goods on credit from your suppliers. Make Accounts Payable Ledger in Excel to maintain the amounts payable to vendors with invoice details. However shareholders equity will not decrease because there is no effect on stockholders equity also payment is made t.

If you remember from bookkeeping basics accounts payable is a. FYI creditors are also known as accounts payable or simply payables. The credit and debit entries are equal to each other.

In simple terms accounts payable ledger consists of the list of suppliers along with details like invoice number date of invoice date wise payments made and outstanding balance. This process includes working with other University departments to ensure that timely and accurate payments are made in compliance with established University policies and procedures. As goods are sold revenue is recognized in an income statement but the cost of goods sold does not equal.

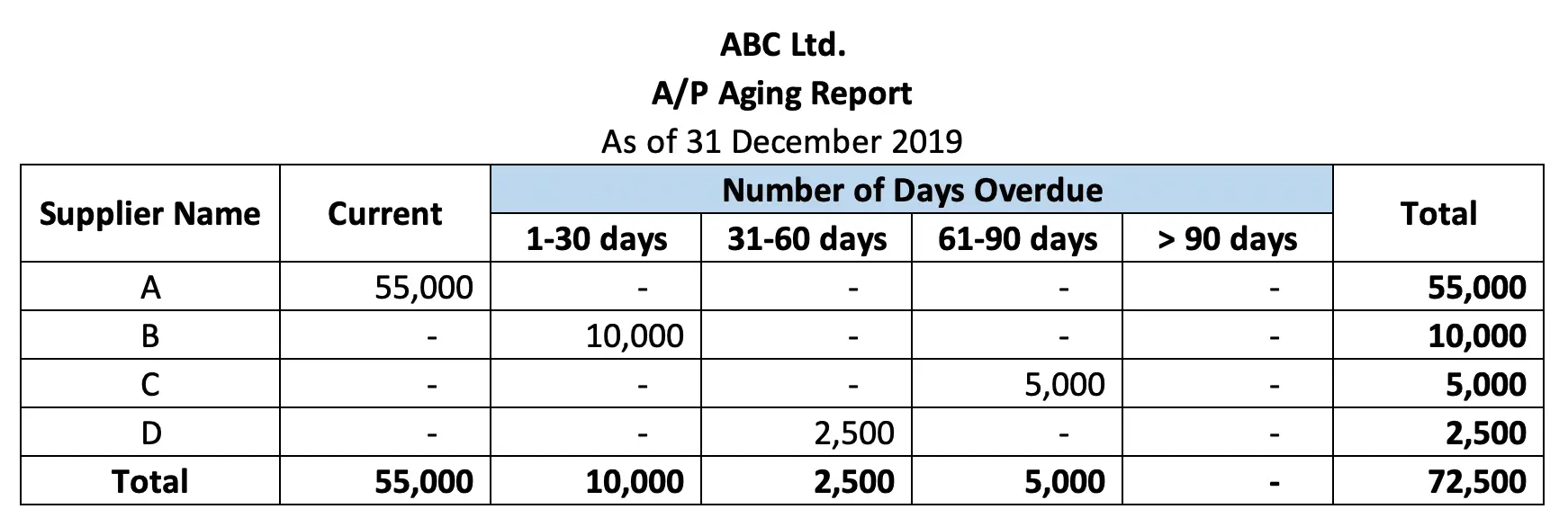

Accounts payable form the largest portion of the current liability section on the companys financial statements. In the cash conversion cycle companies match the payment dates with accounts receivables ensuring that receipts are made before making the payments to the suppliers. For this purpose you create a partial payment invoice in proALPHA.

Long-term debts - such as mortgages and other loans taking more than twelve months to pay off - are typically itemized as separate liabilities and arent included in accounts payable. It is the management of short-term payment obligations to the vendorsupplier. Accounts Payable consists of 3 basic functions.

Accounts payable refers to the vendor invoices against which you receive goods or services before payment is made against them. Accounts Payable Accounts payable is a liability incurred when an organization receives goods or services from its suppliers on credit. When the payment is made to a creditor or payable.

SAP Accounts Payable Process P2P Process. The payable is essentially. Accounts payable ledger is an excel spreadsheet in to.

Accounts payable is what a company owes to suppliers or vendors for received goods or services. This invoice shows the amount you owe for goods and services and is added to your AP balance. The term accounts payable refers to the individual balance sheet account that tracks the short-term debts for business goods and services bought on credit as well as to the business department responsible for repaying these short-term debts.

When you pay on account it means you are paying off an account you have with someone meaning a debt. Moreover it will include the bank accounts information in which youll make payments terms and conditions of the amount youve along with the suppliers payment. Lets discuss some of the typical journal entries related to accounts payable which are frequently used to manage the accounts payable function.

Then set the account payable application according to the gathered data. Entry when utility bill is paid. Creating accounts payable as partial payment invoices.

1 When payment is made to accounts payable total expense will remain the same as there will be no effect in the expense account.

How The Accounts Payable Process Works In 5 Steps The Blueprint

Accounts Payable Vs Accounts Receivable Overview Of Differences

Accounts Payable Process 7 Steps Of Payables Process Accountinguide

Accounts Payable Examples Full List With Explanation

Accounting Payable Process Accounts Payable System Meru Accounting

Accounting Payable Process Accounts Payable System Meru Accounting

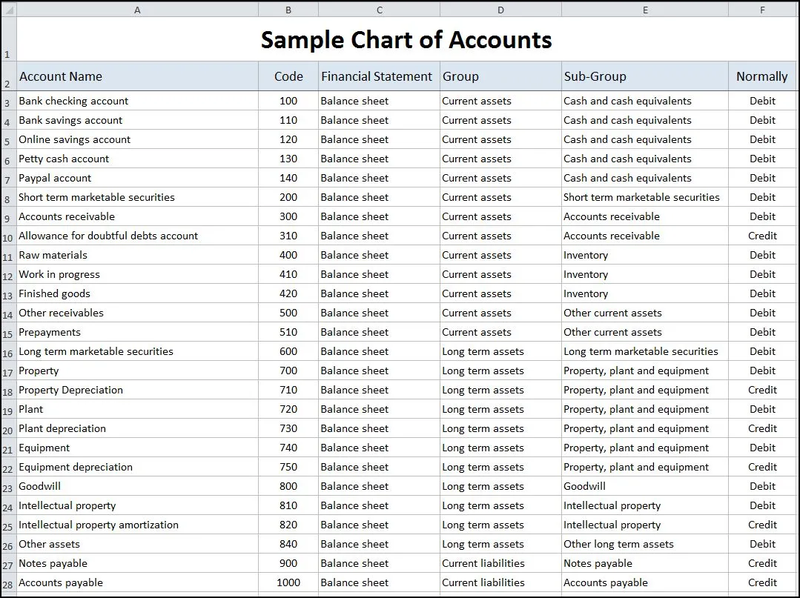

Chart Of Accounts Odoo 15 0 Documentation

Accounts Payable Explanation Accountingcoach

What Is Accounts Payable Ap Definition Journal Entries Examples

How The Accounts Payable Process Works In 5 Steps The Blueprint

Accounts Payable Process 7 Steps Of Payables Process Accountinguide

Accounts Payable Cycle Step For The Accounts Payable Cycle

Accounts Payable Examples Full List With Explanation

Accounts Payable Process Accountingcoach

Accounts Payable Journal Entry Example Accountinguide

Comments

Post a Comment